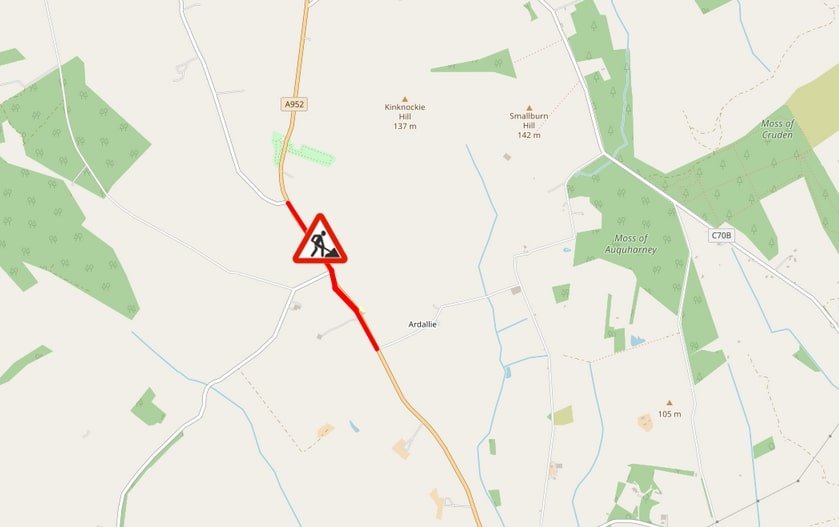

Road Junction A90 and A952

Road Closure Before road Junction on A90 and A952

Cortes Junction

| Start Date: | 20 Sep 2021 |

| End Date: | 22 Sep 2021 |

| Location | A90 (Jn R B9033 St. Combs to Start Of One Way (Wb)) to A90 (Jn T A952 Cortes to Jn L B9032 Memsie), |

| Description Works: | Lining Works, Resurfacing |

| Traffic Management: | Road Closure |

| Diversion Information: | Diversion via A952 to Lonmay and reverse |

Plan Ahead

Follow Peterhead.Live on Facebook or Twitter for get more actual information.