Best Historic Tour Operator Peterhead Prison Museum 23-24

Best Historic Tour Operator Peterhead Prison Museum 23-24

Congratulations to Peterhead Prison Museum

Business in Peterhead, Aberdeenshire, Scotland

Best Historic Tour Operator Peterhead Prison Museum 23-24

Congratulations to Peterhead Prison Museum

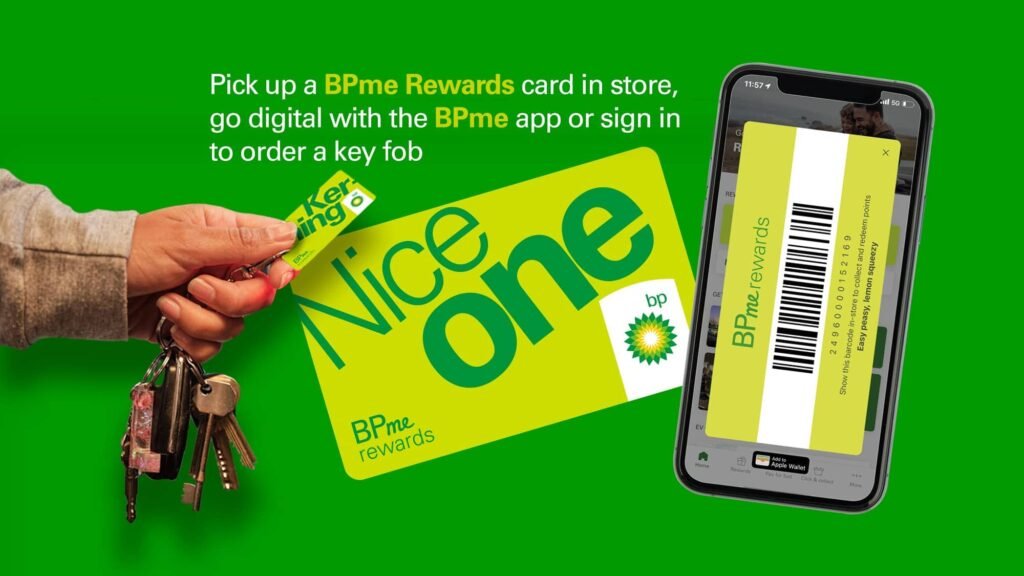

Peterhead Motors are changing fuel supplier

Peterhead Petrol station at South road will be closed from June 17 to June 20 to carry out rebranding work.

Installation of NEW POLE SIGN, CANOPY, PUMPS, SHOP SIGNAGE, TILLS, CREDIT CARD MACHINES.

PLEASE MAKE SURE YOU HAVE PICKED UP A BPme REWARDS CARD READY TO COLLECT POINTS FROM THE GO!

4 local businesses wins at Scotland-wide business awards

Aden Country Park cafe closes

Buchan food and drink festival 29.02

Buchan food and drink festival 29.02

Buchan Sustainable Transport Study

A90 / A952 Appraisal and Buchan Sustainable Transport Study

Producers to Apply for Funding

MSP Urges Local Producers to Apply for Funding

SeaFest hailed roaring success

SeaFest Peterhead hailed roaring success

SeaFest Peterhead lined-up to have a promising first event